Heron Data launches Bank Statement Parsing & Fraud Detection

- 22nd November 2022

We started Heron Data to simplify the process of understanding an SMB’s financial health. In early 2020 it was the midst of the Open Banking revolution – an age where financial data could seamlessly move from antiquated institutions to wherever the data subject wanted it to be. Plaid, Finicity, TrueLayer, and a roster of other players were founded to make that data transfer easy. We thought that the age of downloading and sending three months of bank statements as part of your loan application were over. How wrong we were!

When we started Heron we only accepted data in text format (JSON / CSV / etc.) but every day we heard from our customers that applicants banking with regional banks or credit unions had issues connecting via API aggregators because ‘the institution is not supported’. Some applicants are simply unwilling to give access to their bank account to a tool they might not trust. Many traditional lenders, especially those who receive leads through brokers or ISOs, have a primarily PDF-based dealflow. Even for the most tech-forward lenders PDF statements make up a significant minority of applicant volume. Our customers were faced with the choice of ignoring PDF-based deals or manual processes which limited automation.

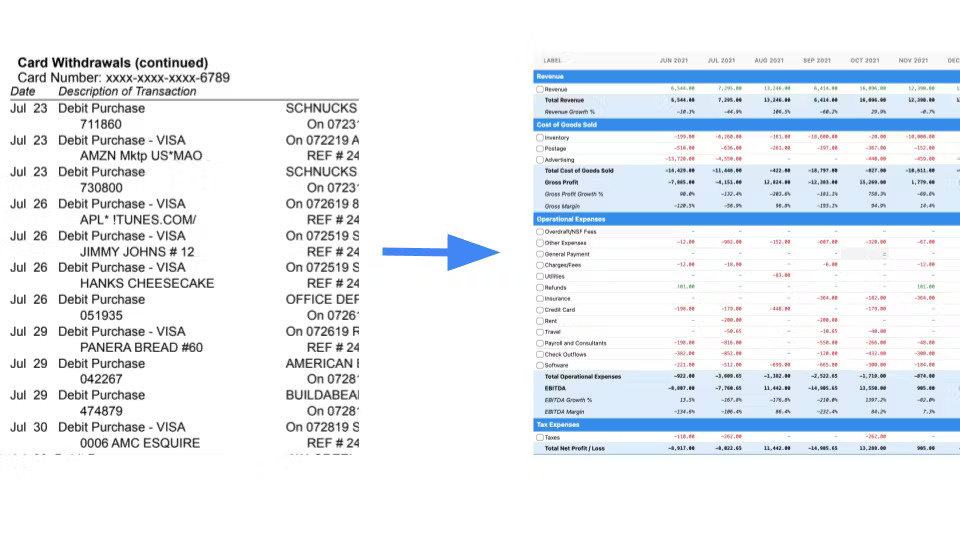

After six months in closed beta – we are excited to launch bank statement parsing and fraud detection! You can now send Heron PDF bank statements in addition to data pulled through API aggregators (you can even send data from multiple sources for the same company) and we will carry out fraud checks and parse the statement’s transactions, balances, and other key data points.

We process ~90% of bank statements with 99%+ accuracy without a human-in-the-loop. The whole process takes less than a minute and we’ll tell you up front if we can’t parse the document successfully so you can make other arrangements. After parsing the data, we enrich it and you can view the results in our intuitive Dashboard or calculate Metrics about the company like true revenue, balance analytics, NSF days, DSCR, and much more. If you share your underwriting criteria (e.g. a minimum revenue requirement, minimum average balance, # of NSF days for example), we will tell you in real time whether the applicant qualifies so you can make sure your Underwriters only spend time on opportunities that are likely to convert.

If you’d like to join 100+ other B2B Lenders and Fintechs in automating bank-statement based workflows with Heron or are interested in testing out our solution, book a demo or drop us an email at [email protected].